Phone

+91 8979141354

info@lawgicalstation.com

TDS Return is a quarterly statement that needs to be submitted by the deductor to the Income Tax Department. The statement shows a summary of all the entries for TDS collected by the deductor and the TDS paid to the Income Tax Authority. The tax is required to be deducted at the time money is credited to the payee's account or at the time of payment, whichever is earlier.

Usually, the person receiving income is liable to pay income tax. But the government with the help of Tax Deducted at Source provisions makes sure that income tax is deducted in advance from the payments being made. The recipient of income receives the net amount (after reducing TDS). The recipient will add the gross amount to his income and the amount of TDS is adjusted against his final tax liability. The recipient takes credit for the amount already deducted and paid on his behalf

TDS certificates have to be issued by the payer deducting TDS to the payee from whose income TDS was deducted while making payment. Form 16, Form 16A, Form 16B, and Form 16C are all TDS certificates.

| Form | Certificate of | Frequency | Due date |

|---|---|---|---|

| Form 16 | TDS on salary payment | Yearly | 31st May |

| Form 16A | TDS on non-salary payments | Quarterly | 15 days from due date of filing return |

| Form 16B | TDS on sale of property | Event based | 15 days from due date of filing return |

| Form 16C | TDS on rent | Event based | 15 days from due date of filing return |

The due dates for filing TDS return for FY 2021-22 are as follows:

| Quarter | Quarter Period | TDS Return Due Date |

|---|---|---|

| 1st Quarter | 1st April to 30th June | 31st July, 2021 |

| 2nd Quarter | 1st July to 30th September | 31st October, 2021 |

| 3rd Quarter | 1st October to 31st December | 31st January, 2022 |

| 4th Quarter | 1st January to 31st March | 31st May, 2022 |

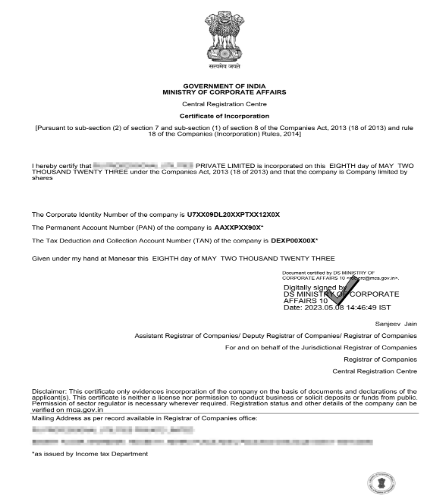

TDS returns can be filed by employers and organizations who have a valid Tax Deduction and Collection Account Number (TAN). Any person making specified payments mentioned under the Income Tax Act is required to deduct tax at source and deposit it to the Central Government within the stipulated time.

An assessee is liable to file a TDS return if TDS is deducted from his/her income. The assessees liable to file quarterly TDS return can be a company or people whose accounts are Audited u/s 44AB or he is holding an office under the Government.

TDS is payable on the earnings so it is important to note that the liability to pay TDS is applicable only in the event of earnings taking place. TDS is deducted before making payments. Deductions are to be made on payments that are made in cash, cheque, or credit. The amount deducted under TDS is further deposited with various government agencies.

Payment of TDS has various advantages which are as follows: