Phone

+91 8979141354

info@lawgicalstation.com

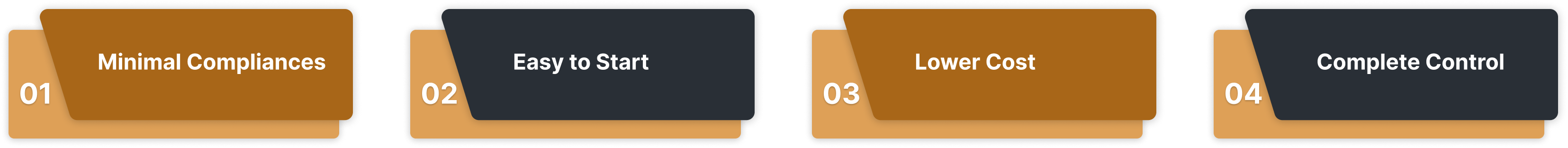

Sole proprietorship is a type of business entity which is owned and managed by a single person only. It is not governed by any law and hence it is the easiest form of business in India. All the decisions and management of the business is in the hands of one person.

The process of registering your business as a sole proprietorship firm is not much complicated. Our experts at Lawgical Station can make the whole registration process hassle-free for you. Register your firm online in 3 easy steps

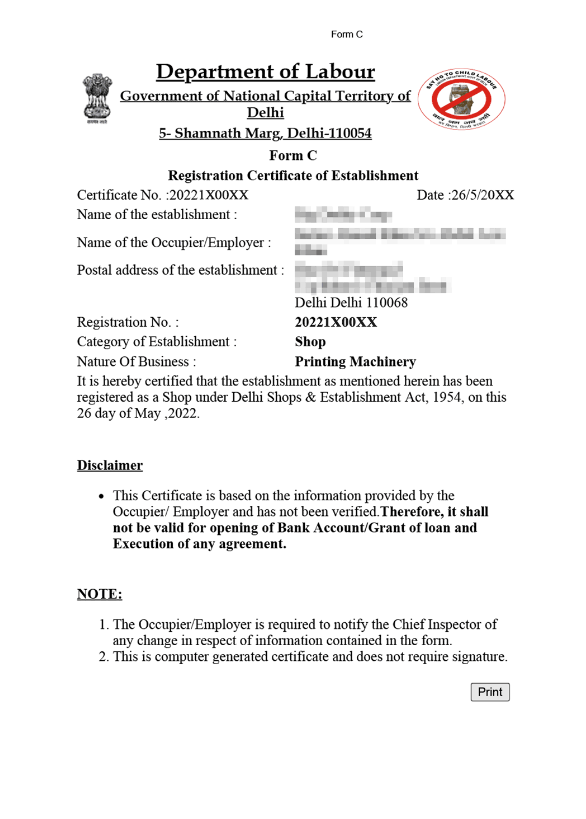

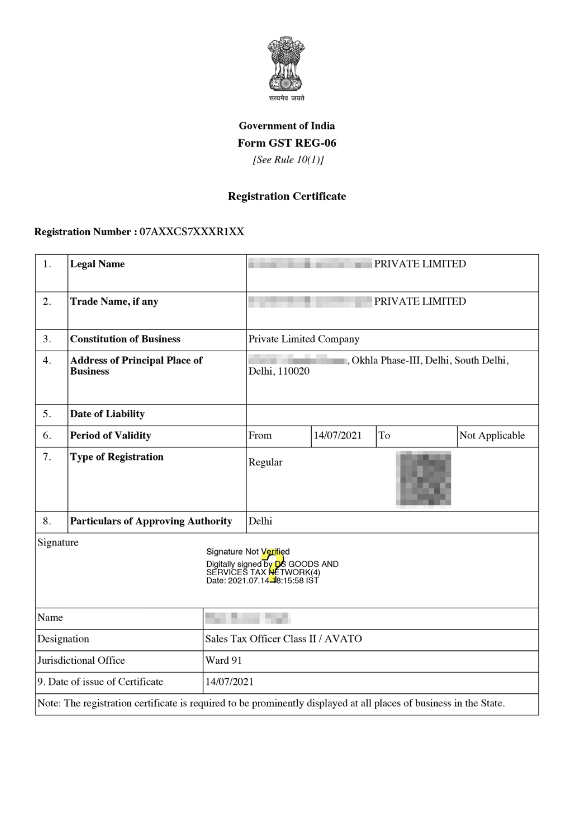

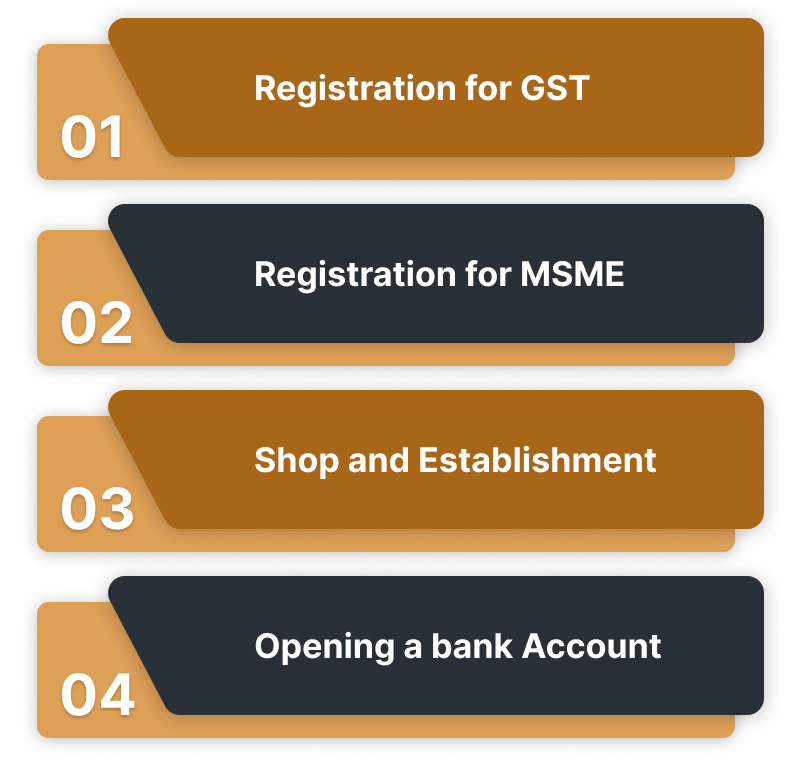

Post incorporation of your sole proprietorship firm, you'll receive the following documents:

The cost depends on various factors. You can get in touch with our experts for detailed input on the actual cost.

Yes a sole proprietorship can be converted into a private limited company. You will have to follow the standard procedure for the same. Get in touch with our experts for more information.

A real-life example of a sole proprietorship could be a local bakery owned and operated by a single individual.

GST registration is required for sole proprietorships if their annual turnover exceeds the threshold.

Yes, a sole proprietorship can have a PAN card, which is necessary for income tax purposes and financial transactions.