The LLP Agreement is a legal document that outlines the rights, responsibilities, and obligations

of partners in a Limited Liability Partnership (LLP). It governs the internal operations,

profit sharing, decision-making, and dispute resolution within the LLP.

The income tax rate for an LLP is 30% of the total income. Additionally, a surcharge and

health and education cess may apply based on the LLP's annual income and the prevailing

tax regulations.

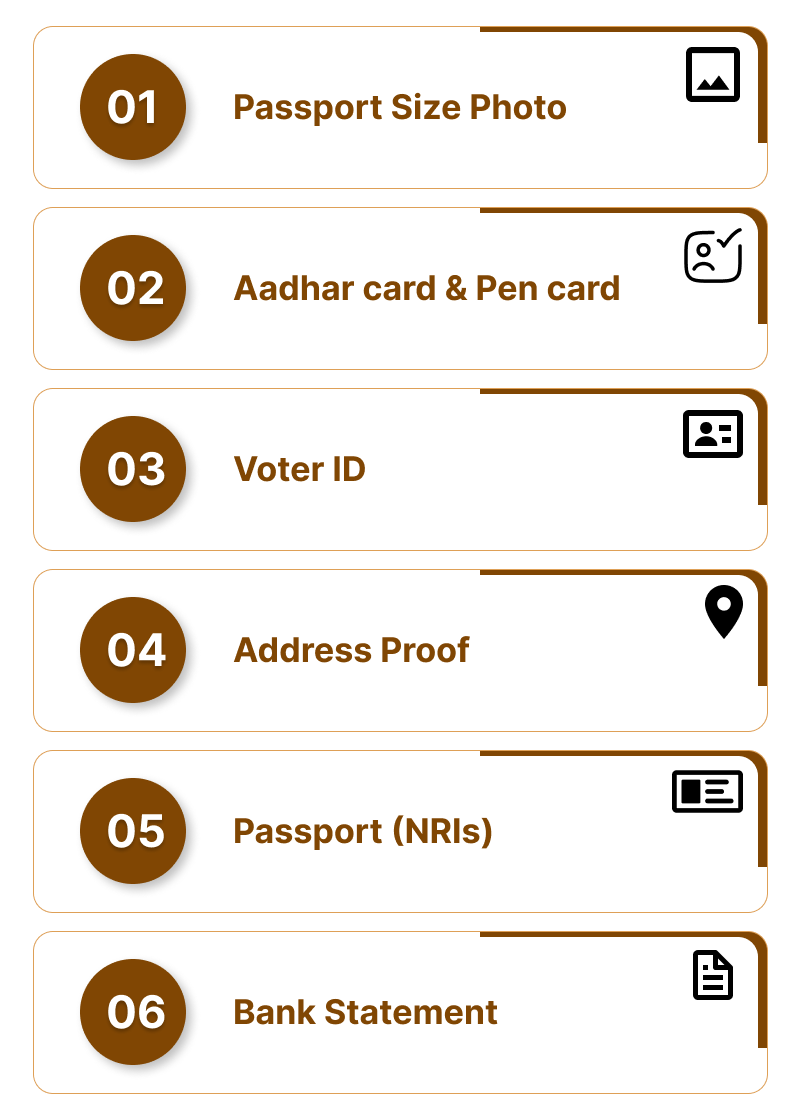

LLP compliance under the Companies Act of 2013 refers to the statutory obligations that LLPs

must fulfil. This includes filing annual returns, maintaining proper books of accounts,

conducting audits, complying with tax regulations, and adhering to other legal requirements.

Yes, LLPs are required to file their annual income tax return irrespective of profit or loss.

The LLP's income tax return (ITR) must be filed electronically using the prescribed forms

and within the due dates specified by the tax authorities.

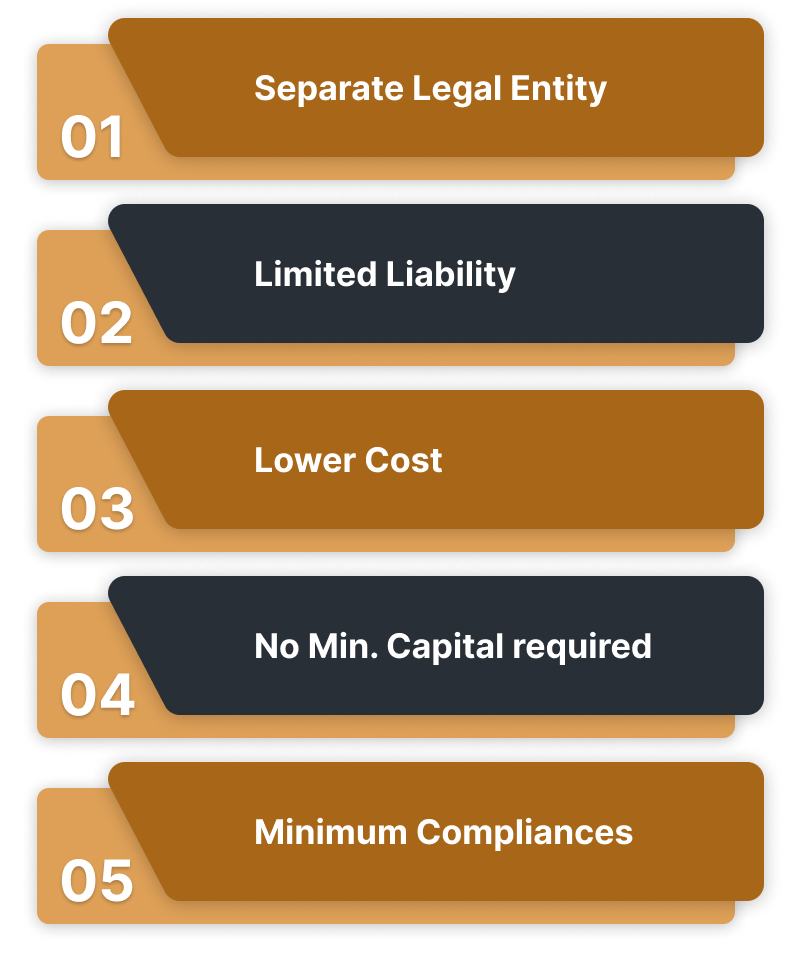

An LLC is a business entity that combines the features of a corporation and a partnership.

It is privately owned and managed by its directors. On the other hand, an LLP is a partnership

where the liability of the participants is limited to the amount they invest in the business.

In an LLP, the directors are also the owners of the firm.