Phone

+91 8979141354

info@lawgicalstation.com

Section 8 company is an upgraded form of Society and Trust. It has many benefits over traditional forms of charitable institution registration. Section 8 company is the most popular form of NGO registration in India. It is easy to register, run and manage.

The main purpose of Section 8 company is to promote non-profit objectives such as commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment and other charitable purposes.

In effect from April 1, 2021, all NGOs need to file Form CSR-1 on MCA portal to register with Central Government. MCA has made this Form available on its website and made it mandatory for all the social organisations seeking CSR funds or CSR implementing agencies to file it. The aim of the CSR-1 Form is efficient monitoring of CSR spendings in the country

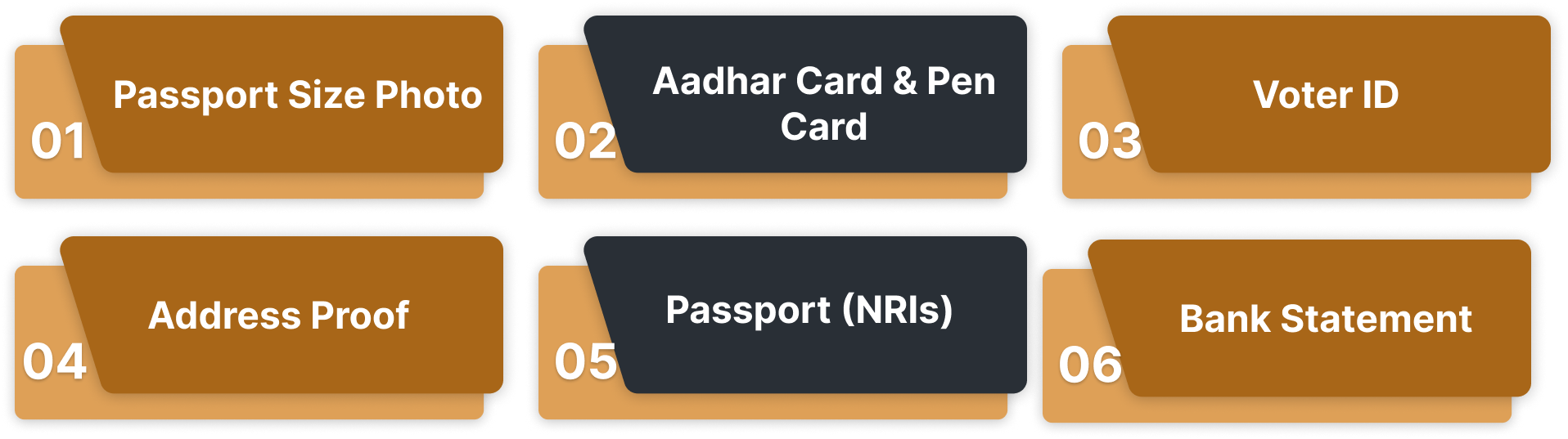

Section 8 Company incorporation is a complete digital process and therefore requirement of Digital Signature Certificate is a mandatory criteria. Directors as well as subscribers to the memorandum of the company need to apply for a DSC from the certified agencies. Obtaining a DSC is a complete online process and it can be done within 24 hours. This process involves 3 simple verifications that are document verification, video verification and phone verification.

Name application for Section 8 Company can be done through SPICE RUN form which is a part of SPICe+ form. While making the name application of the company, industrial activity code as well as object clause of the company has to be defined.

Note: It should be ensured that company name does not resemble the name of any other already registered company and also does not violate the provisions of emblems and names (Prevention of Improper Use Act, 1950). You can easily check the name availability by using our company name search tool to verify the same.

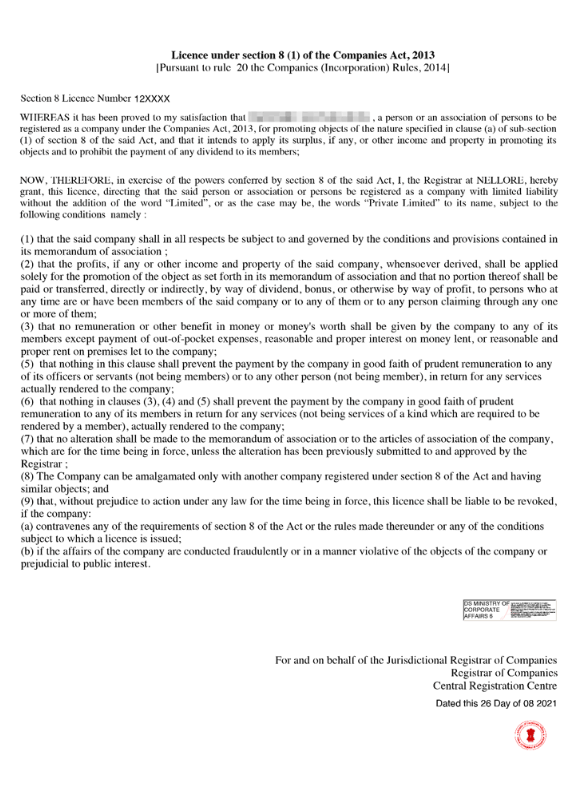

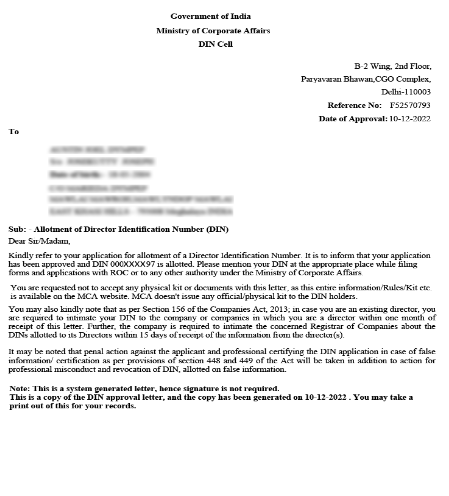

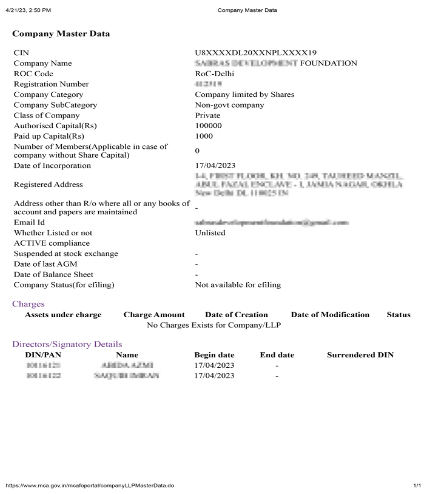

For obtaining the license under Section 8 Company, Form INC-12 is required to be filed with the Registrar of Companies. Prior to issuance of Certificate of Incorporation for Section 8 company, approval letter under Section 8 of Part 1 i.e, License under Section (1) of the Companies Act, 2013 is issued from the Ministry of Corporate Affairs. Once the form is approved by the Central Government, ROC will issue a 6-digit Section 8 license number.

Post name approval, details with respect to registration of the company has to be drafted in the SPICe+ form. It is a simplified proforma for incorporating a company electronically. The details in the form are as follows:

Post name approval, details with respect to registration of the company has to be drafted in the SPICe+ form. It is a simplified proforma for incorporating a company electronically. The details in the form are as follows:

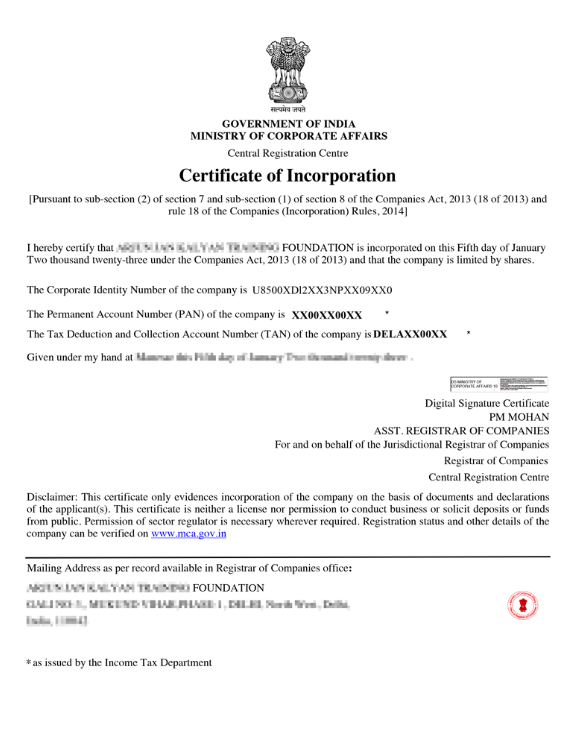

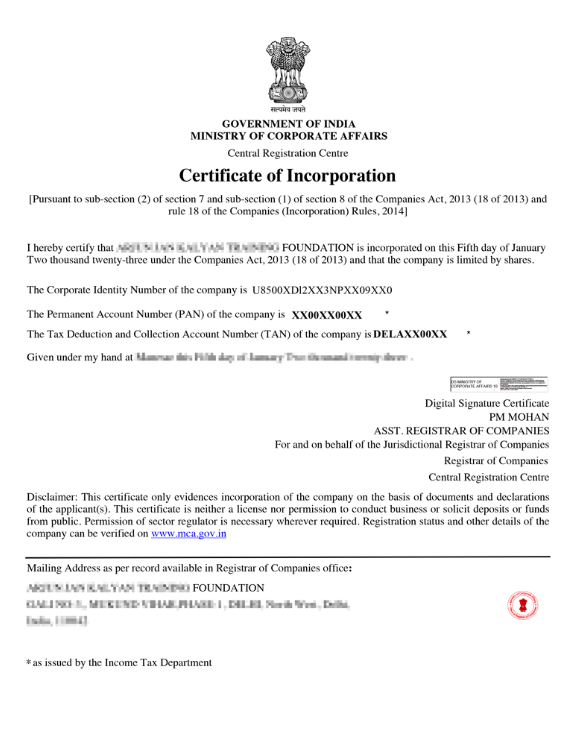

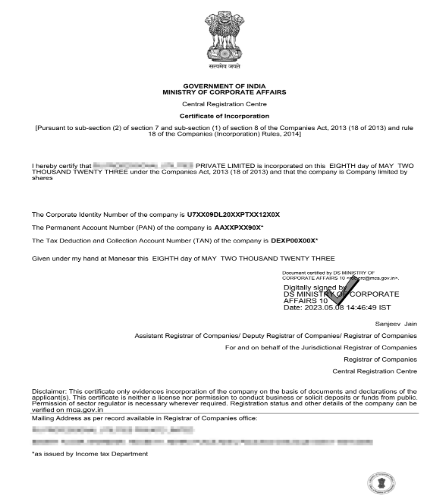

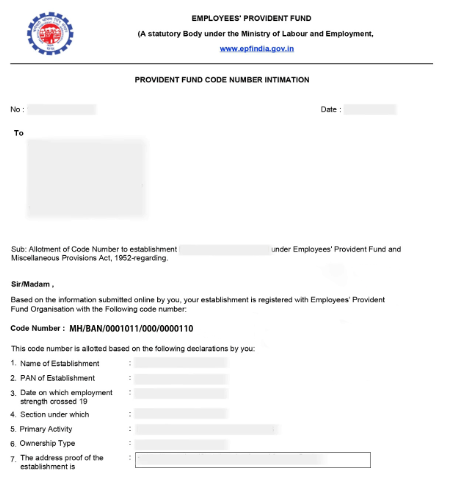

Post approval of the above mentioned documents from the Ministry of Corporate Affairs; PAN, TAN & Certificate of Incorporation will be issued from the concerned department. Now, the company is required to open a current bank account by using these documents. You can contact us for assistance with your current bank account opening

The process of Section 8 company registration is complicated and involves various compliances. Our experts at Lawgical Station can simplify the whole registration process for you. Register your Section 8 company online in 3 easy steps

No, Section 8 companies are generally exempt from paying income tax on their income derived from activities aligned with their objectives, such as social welfare, education, or research. This exemption is granted under Section 12AA of the Income Tax Act, 1961.

However, there are few exceptions:

There is no maximum limit for the number of members in a Section 8 Company. The company can have any number of members as required for achieving its objectives.

Yes, NRIs (Non-Resident Indians) and foreign nationals can be Directors in a Section 8 Company in India. However, they must comply with regulatory requirements, such as obtaining a Director Identification Number (DIN) and fulfilling other legal obligations.

Alternatives for starting a non-profit organization (NGO) in India include forming a Trust, a Society, or a Section 8 Company. The choice depends on the specific goals, governance structure, and legal requirements of the organization.

Yes, Section 8 Companies can raise foreign funding with the approval of the government authorities and compliance with the Foreign Contribution (Regulation) Act, 2010.