You can start a Limited Company with any amount of capital. However,

the fee must be paid to the Government for issuing a minimum of

shares worth Rs.5 lakhs [Authorized Capital Fee] during the

incorporation of the Company. There is no requirement to show

proof of capital invested during the incorporation process.

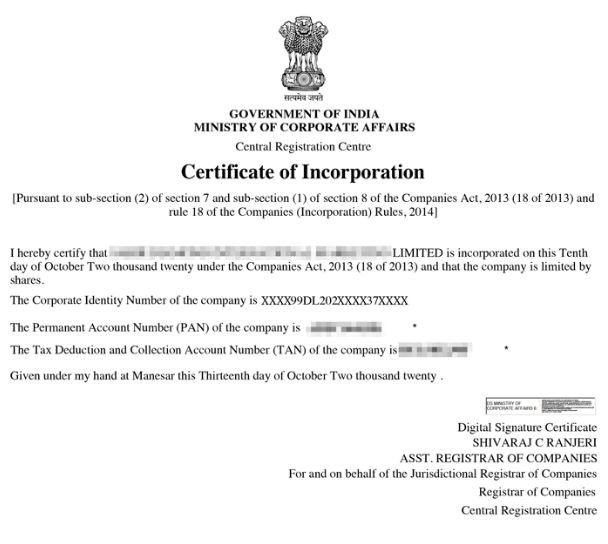

Once a Company is incorporated, it will be active and in existence as long as

the annual compliances are met with regularly. In case, annual compliances

are not complied with, the Company will become a Dormant Company and may be

struck off from the register after a period of time. A struck-off Company

can be revived for a period of up to 20 years.

An address in India where the registered office of the Company will

be situated is required. The premises can be commercial/industrial/residential

where communication from the MCA will be received.

100% Foreign Direct Investment is allowed in India in many of the

industries under the Automatic Route. Under the Automatic Route,

only a post-investment filing is necessary with the RBI indicating

the nature of investment made. There are a few industries that require

prior approval from the RBI, in such cases, approval must first be

obtained from RBI prior to investment.

A limited company must hold a Board Meeting at least once every 3 months.

In addition to the Board Meetings, an Annual General Meeting must be

conducted by the Private Limited Company, at least once every year.

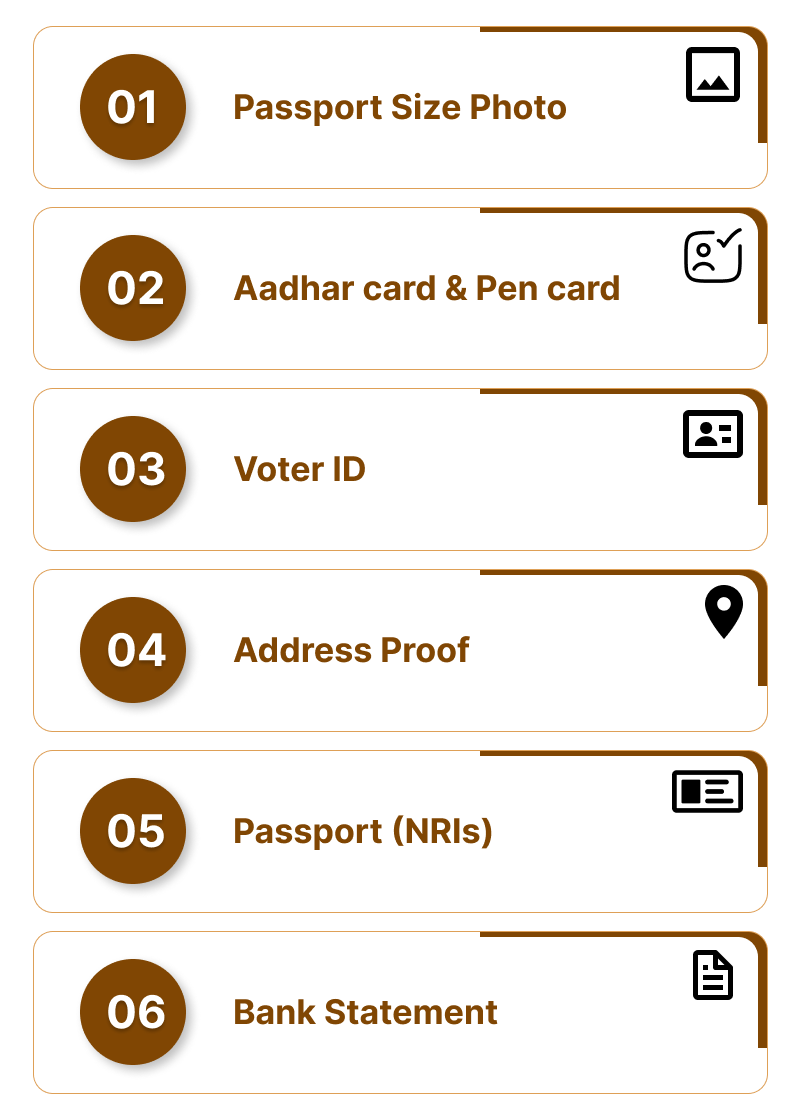

Yes, a NRI or Foreign National can be a Director in a Limited Company

after obtaining Director Identification Number. However, at least one

Director on the Board of Directors must be a Resident India.