A startup defined as an entity that is headquartered in India, which was opened less than 10 years ago and has an annual turnover of less than ₹100 crores (US$14 million).

Phone

+91 8979141354

info@lawgicalstation.com

The Startup India is a program to encourage and support the startup ecosystem in India. It aims to promote new businesses by providing them various benefits & exemptions. Such as tax holidays & access to government funding and incubator programs. The benefits of the program can be accessed by startups through DPIIT recognition.

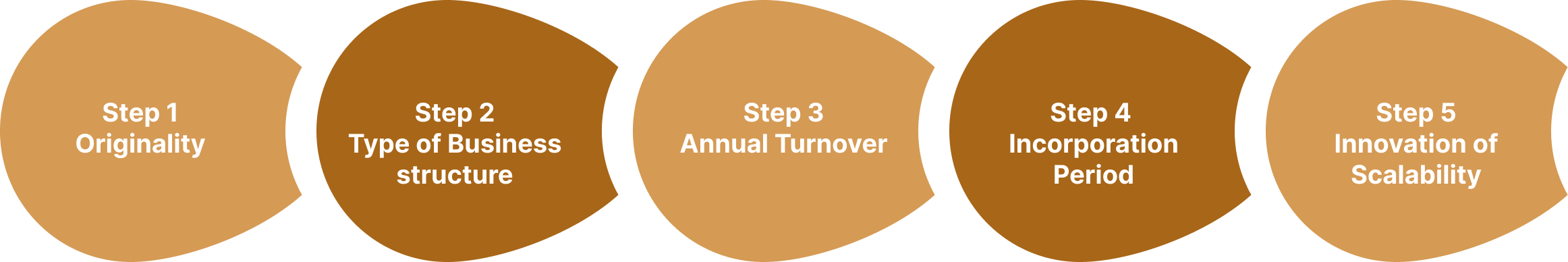

The following documents are needed to be submitted by the entities for recognition of Startup India by DPIIT.

A startup defined as an entity that is headquartered in India, which was opened less than 10 years ago and has an annual turnover of less than ₹100 crores (US$14 million).

Typically, only start-ups that will not be looking for venture capital funding register LLPs. This is because venture capitalists only invest in private and public limited companies.

According to the Economic Times, as of 2020, the top-earning businesses in India are from the financial services, transport and support services, aerospace, defence, and security services, technology services, and health and education services.

Any individual, or even a company or an LLP, can become a partner. However, only an individual can become a ‘designated partner’ in an LLP.

Yes, it is much cheaper to run an LLP than a private limited company, particularly in your early start-up days. This is because many compliances, such as an audit, apply to LLPs only after their turnover is sizable. Most LLPs spend about half as much as a private limited company in their first year on registrations and compliance work.