Nidhi Companies are regulated by the Ministry of Corporate Affairs (MCA) in India. They are also governed by rules set out in the Companies Act 2013.

Phone

+91 8979141354

info@lawgicalstation.com

Nidhi Company is a type of Non-Banking Financial Company (NBFC). Its major function is lending and borrowing money to its members. The objective is to cultivate the habit of savings amongst its members and work on the principle of mutual benefits that are regulated by the Ministry of Corporate Affairs.

Nidhi Company is not required to receive the license from Reserve Bank of India (RBI), hence it is very easy and convenient to form. It is also known as Mutual Benefit Finance Company. It is registered as a public limited company and must include "Nidhi Limited" as the last words of its name.

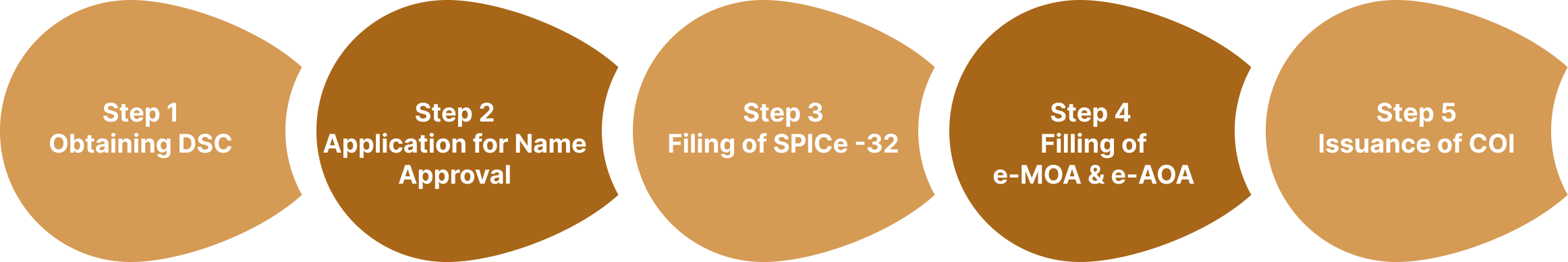

The process of Nidhi company registration is complicated and involves various compliances. Our experts at Lawgical Station can simplify the whole registration process for you. Register your Nidhi company online in 3 easy steps:

Post incorporation of nidhi company, you'll receive the following documents:

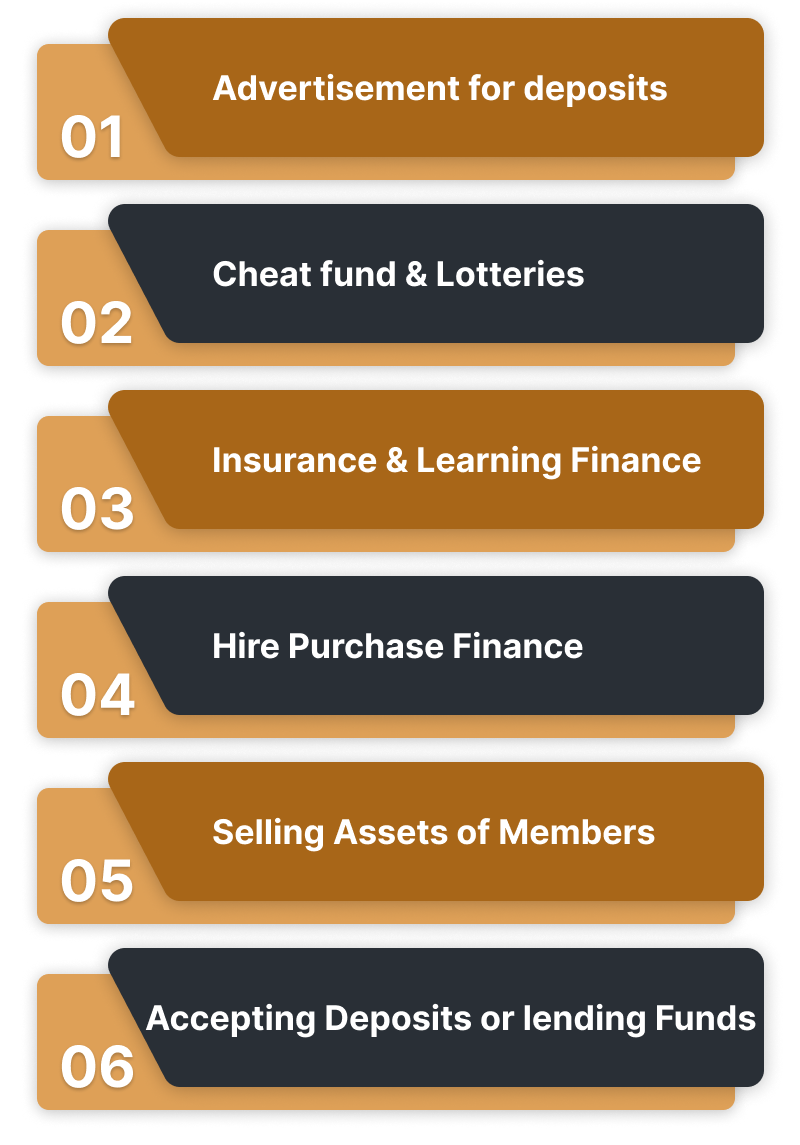

As Nidhi companies are involved in a non-banking financial transaction, they are prohibited from performing the following activities:

Nidhi Companies are regulated by the Ministry of Corporate Affairs (MCA) in India. They are also governed by rules set out in the Companies Act 2013.

No, you don't need to be present in-person to start a Nidhi Company. The whole process can often be done online. You need to fill in the right forms and provide the necessary documents.

Rule 10 of Nidhi Rules, 2014, states that a Nidhi Company must open at least three branches only after it has gained 1000 members. Also, these branches must be within the district where the registered office of the Nidhi Company is located.

No, to apply for a loan from a Nidhi firm, you must be a registered member. Non-members are not allowed to avail themselves of the loan facility.

No, a Nidhi company is prohibited from issuing preference shares. It can only issue equity shares to its members.

Each share issued by a Nidhi company must have a minimum par value or face value of ₹ 10 (ten rupees).